- Business

Checking

Plans to fit businesses of all sizes.

Savings

Unlimited deposits and a low minimum balance.

Services

Other innovative products that can help streamline your business.

Business Loans

A variety of loans and credit line options.

Commercial Mortgages

Whether you’re looking to purchase, build, or renovate.

Debit & Credit Cards

Get rewarded with cash back or valuable perks.

Certificates of Deposit

Savings with competitive rates and no fees.

- Personal

Checking

Simple accounts that work for you.

Savings

Saving in Hawaii can be hard. We’ll try to make it easy.

Services

Get help from the branch to your mobile device.

Personal Loans

Money when you need it, with flexible draw and repayment terms.

Home Loans

Trying to get the keys to your dream home? We can help.

Debit & Credit Cards

Get rewarded with cash back or valuable perks.

Certificates of Deposit

Earn higher rates with Hawaii Certificates of Deposit.

Retirement

Save for your future while reducing your taxes.

- Locations

- Contact

- Sign In

Frequently Asked Questions

Have a question? We can help. Look below to find important information and phone numbers to answer your frequently asked questions.

All of our branches are closed on Saturday and Sunday. However, we do offer 24/7 Online and Mobile banking and you can also visit our ATM's which are also open 24/7.

Please visit our Locations Page to view our holiday closures.

Yes, most branches have safe deposit boxes for rent. Please call the branch for availability.

Oahu

- Main

- Kailua

- Kapiolani

- Kalihi

- Pearl City

Hawaii Island

- Puainako

Maui

- Kahului

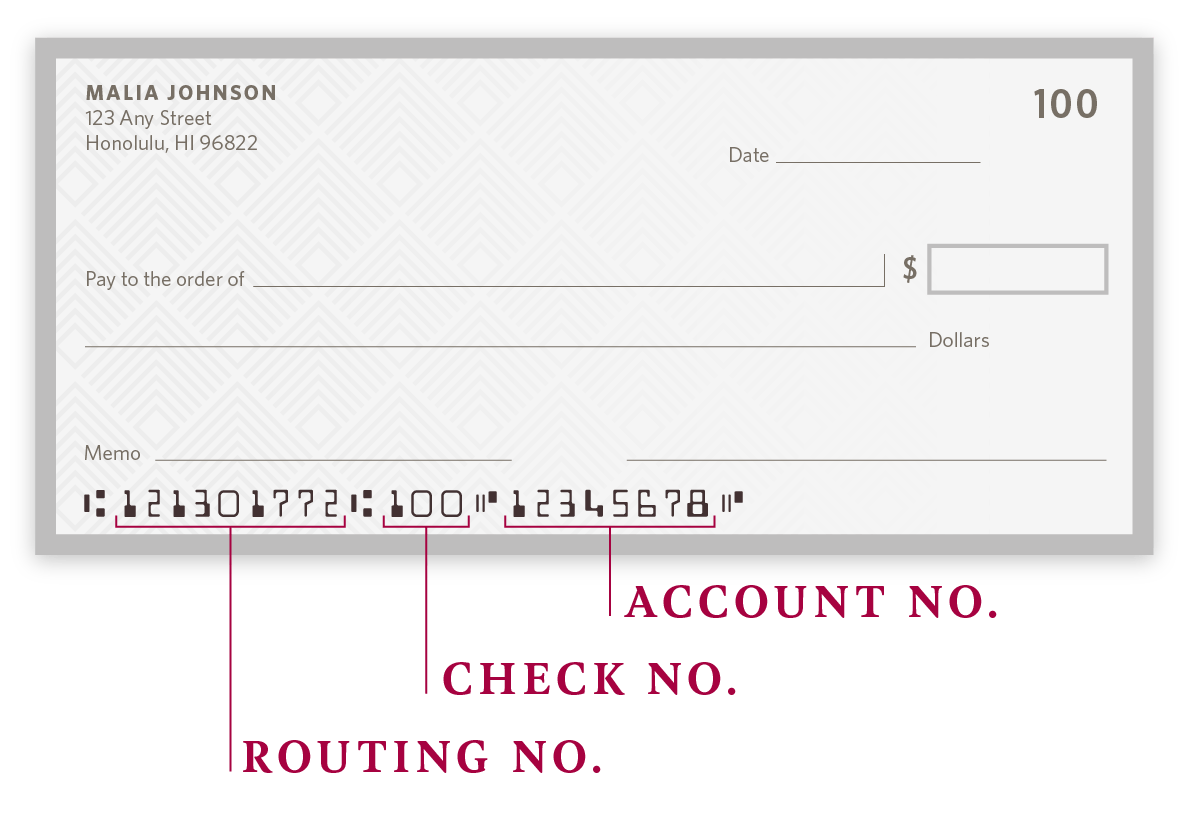

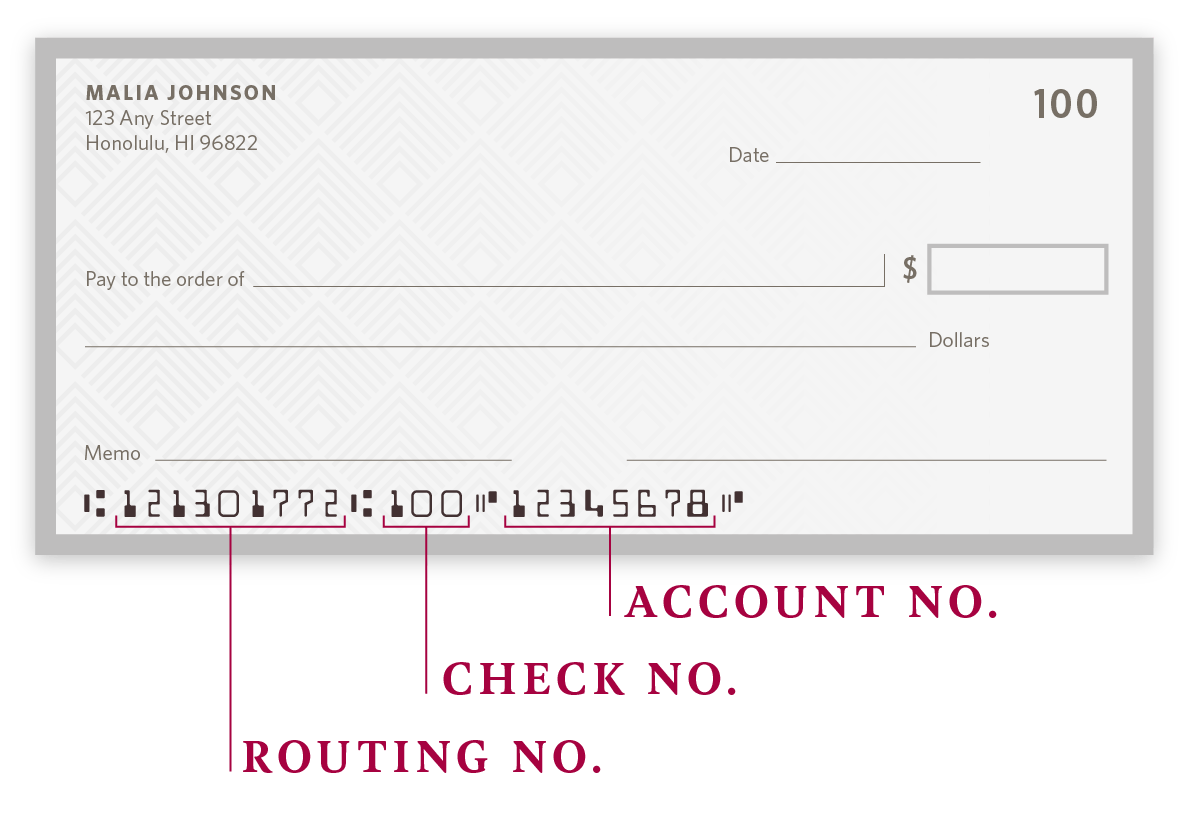

Your account number can be found through your Online and Mobile Banking, and on your checks. The account number is printed along the bottom after the routing number and check number.

If you cannot find your account number, please call your branch of account.

Please contact your branch to make any changes to your account, including change of address, name change, email address, etc.

You can easily request new checks online at https://orderpoint.deluxe.com/personal-checks/welcome.htm.

You may check your balance online, through our mobile app, at an ATM or at any branch.

Opt-in for electronic statements and notifications through the Online Banking platform. For step-by-step instructions, please click here.

eStatements can be accessed through Online Banking and Mobile Banking. In Online Banking, click the “Statements” icon in your dashboard. In the mobile app, scroll left on the dashboard and click on the "Statements" icon.

Minimum Daily Balance refers to the ending balance for each day within the given statement cycle. Monthly Average Balance takes the average of each daily ending balance over the statement period.

We’re sorry for this error. Please call or visit a branch to dispute a transaction.

Please view our open positions on our Careers Page and complete an online application.

There is an ATM available at all branch locations, listed here. Most Hawaii National Bank ATMs are accessible 24/7. Select ATMs also take in envelope-free deposits and can dispense multiple bill denominations.

The limits may vary by user. The standard limit is $300 per account per day. Please contact Digital Banking at (808) 528-7800 or DigitalBanking@HNBhawaii.com if you have any questions.

There is no ATM fee if you use your Hawaii National Bank debit/ATM card at a Hawaii National Bank ATM. If you use your card at a non-Hawaii National Bank ATM, Hawaii National Bank will assess a $1.00 foreign ATM withdrawal fee. Additional fees may be assessed by the ATM's financial institution.

Please contact the appropriate number immediately:

Debit Cards

During Business Hours (M-F 8am-5pm):

- Digital Banking Department: (808) 528-7800

Outside Business Hours

- Within the US: (888) 297-3416

- Outside the US: (206) 389-5200

You may also temporarily block your debit card if you notice suspicious activity through our Online and Mobile Banking app.

Credit Cards

- Within the US: (866) 552-8855

- Outside the US: (701) 461-1922

The default spending limits for personal debit cards are:

- $3,000 for debit card purchases

- $310 daily limit for ATM cash withdrawals

Please note: Your debit card limits may differ from these default limits. Please contact your branch of account or our Digital Banking team at (808) 528-7800 if you have any questions.

Yes, we have a variety of credit cards available with different benefits. Please visit our Credit Cards page to see details about each card, or stop by any branch and we’ll be happy to find the right card for you.

All newly issued and replacement cards after March 1, 2021 will include a contactless feature. You can confirm that your card is contactless if there is the contactless symbol on the back of the card near the security code.

To view the Contactless Debit Card FAQ, please click here.

You can set up travel notices in our Online and Mobile Banking. Click on your settings and go to "Travel notices". Click on "Add travel notice" to enter information about your trip and to select the debit cards you will be using. You may also call our Digital Banking Department for assistance at (808) 528-7800.

We do not allow business accounts to be opened online at this time. Please call (808) 528-7711 or visit any of our branches.

Yes. Please complete our Business Enrollment & Maintenance Form and email it to our Digital Banking Department at DigitalBanking@HNBhawaii.com, or take it to any of our Hawaii branches. A valid government-issued ID is required for all Business Online Banking users.

Please download and complete the Business Enrollment & Maintenance Form. A valid government-issued ID is required for all Business Online Banking users.

You can order new Business checks securely online at https://www.deluxe.com/shopdeluxe/home.

You can access Online Banking through your desktop or laptop with an Internet connection. Mobile Banking is accessed through the Hawaii National Bank mobile app on your smart phone.

Please go to the Online Banking enrollment page to enroll in Online Banking.

Deposits cannot be made through the Online Banking platform. However, deposits can be made through our mobile app. See the Mobile Deposit FAQ section for more information.

Please go to the Online Banking forgot page and provide the requested information.

Please go to the Online Banking forgot page and click on "Try another way" and provide the requested information.

Entering incorrect security information three or more times will temporarily lock your account as a security precaution. Contact us at (808) 528-7800 or DigitalBanking@HNBhawaii.com if you need additional assistance.

We recommend using any of the browsers below:

- Google Chrome

- Mozilla Firefox

- Apple Safari

- Microsoft Edge

*Please note that Internet Explorer will no longer be supported by future internet banking updates.

You can access Online Banking through your desktop or laptop with an Internet connection. Mobile Banking is accessed through the Hawaii National Bank mobile app on your smart phone.

You can download the app via the Apple App Store or the Google Play Store.

Android operating system: Android 5.0 and up

IOS operating system: iOS 11.4 or later

No. Hawaii National Bank offers 24/7 Mobile Banking as a convenient free service for all of our customers enrolled in Online Banking. However, there may be charges associated with data usage on your phone. Check with your wireless phone carrier for more information.

To access the Hawaii National Bank Mobile Banking app, you will need an Internet connection. There may be charges associated with data usage on your phone. Check with your wireless phone carrier for more information.

- Enroll in Online Banking from a desktop computer.

- Download the Mobile Banking app on your mobile device.

- Register your mobile device by entering your Online Banking username and password. You must enroll in two-factor authentication to access Mobile Banking.

- Once two-factor authentication is set up, you may log in to your Mobile Banking.

Contact us at (808) 528-7800 or DigitalBanking@HNBhawaii.com.

Please click on the “Forgot” button on your Mobile Banking app login screen and follow the instructions provided.

Entering incorrect security information three or more times will temporarily lock your account as a security precaution. Contact us at (808) 528-7800 or DigitalBanking@HNBhawaii.com if you need additional assistance.

Yes, however, you can check on "Remember this device" when logging in to make future log in attempts faster. If your device allows Face ID, you may also enable that to easily access your account.

Access to the Mobile Banking app is password protected. To ensure your security, contact us at (808) 528-7800 or DigitalBanking@HNBhawaii.com to block your device for Mobile Banking. You can also call your mobile service provider to have your device disabled.

Supported Apple and Android devices will allow you to use fingerprint authentication instead of your password to log in to the Mobile Banking app. Supported Apple devices will also allow you to use Face ID which uses facial recognition instead of your password to log in.

No. Once Touch ID, Fingerprint Identification, or Face ID is enabled on your supported smart phone, your fingerprint or facial recognition is the only required login credential. You will need to enter your password to make certain banking transactions.

Mobile Deposit allows you to conveniently and securely deposit checks by taking a photo of your check with your smart phone and uploading it through our Mobile Banking app. Please view step by step instructions on how to use Mobile Deposit here.

No. Mobile Deposit is a free service for customers. There may be charges associated with data usage on your phone. Check with your wireless phone carrier for more information.

Please call digital banking to confirm your limit. Limits are based on customer's account standing. Please refer to the HNB Mobile Capture Agreement for more information.

4 p.m. Hawaii Standard Time (HST). Checks submitted after 4 p.m. HST or on weekends and holidays will be processed as if they were submitted on the next business day. Funds are usually available the next business day.

Checks must be endorsed with “For Mobile Deposit at Hawaii National Bank.” After deposit, we will send you a confirmation that we have received an image of the check. Mark the check “Electronically Presented” and retain for your records until the check is processed. Do not resubmit the check.

Bill Pay allows you to make payments to anyone with a mailing address in the United States from your Hawaii National Bank account. You can make payments with the Mobile Banking app on a mobile device, or through Online Banking on a desktop or laptop computer.

Personal customers can enroll through Online Banking.

Business customers need to contact Digital Banking at (808) 528-7800 or DigitalBanking@HNBhawaii.com. By signing up for our Business Bill Pay, you are agreeing to our monthly fee for the service.

There is no fee for our Consumer Bill Pay service. Business Bill Pay fees are $5.95/month + $0.29/transaction for business accounts. Please contact our Digital Banking team to sign up for Business Bill Pay.

Log in to Online Banking and access your Bill Pay profile to add payees.

Under the “History” tab, swipe left or click on the payment you want to cancel and click “Cancel.” You will be prompted to confirm the cancellation.

You may contact our Digital Banking Team for assistance will Bill Pay at (808) 528-7800 or DigitalBanking@HNBhawaii.com.

External transfers allow personal account holders to conveniently transfer funds between accounts they own at Hawaii National Bank and other financial institutions.

No, this service is free for personal account holders.

Please call digital banking to confirm your limit. Limits are based on customer's account standing.

External transfers will be processed on the date you specify, and the funds will usually be made available in 3-5 business days.

No, you must be the owner of both accounts.

Please view our External Transfers Guide for step-by-step instructions.

- After logging in to the mobile app, click on the "Transfer" icon on the dashboard.

- Click on “Make external transfers” and follow the instructions.

Note: You will need to verify the external account by confirming small deposits made into the account.

Categories

Questions

All of our branches are closed on Saturday and Sunday. However, we do offer 24/7 Online and Mobile banking and you can also visit our ATM's which are also open 24/7.

Please visit our Locations Page to view our holiday closures.

Yes, most branches have safe deposit boxes for rent. Please call the branch for availability.

Oahu

- Main

- Kailua

- Kapiolani

- Kalihi

- Pearl City

Hawaii Island

- Puainako

Maui

- Kahului

Your account number can be found through your Online and Mobile Banking, and on your checks. The account number is printed along the bottom after the routing number and check number.

If you cannot find your account number, please call your branch of account.

Please contact your branch to make any changes to your account, including change of address, name change, email address, etc.

You can easily request new checks online at https://orderpoint.deluxe.com/personal-checks/welcome.htm.

You may check your balance online, through our mobile app, at an ATM or at any branch.

Opt-in for electronic statements and notifications through the Online Banking platform. For step-by-step instructions, please click here.

eStatements can be accessed through Online Banking and Mobile Banking. In Online Banking, click the “Statements” icon in your dashboard. In the mobile app, scroll left on the dashboard and click on the "Statements" icon.

Minimum Daily Balance refers to the ending balance for each day within the given statement cycle. Monthly Average Balance takes the average of each daily ending balance over the statement period.

We’re sorry for this error. Please call or visit a branch to dispute a transaction.

Please view our open positions on our Careers Page and complete an online application.