NEED HELP?

Frequently Asked Questions

The answers you’re looking for might already be here. Explore our FAQ topics and if you still can’t find what you’re looking for, please reach out to us. We’re always here to guide you in the right direction.

Categories

General

Are any Hawaii branches open on Saturday?

Are any Hawaii branches open on Saturday?

All of our branches are closed on Saturday and Sunday. However, we do offer 24/7 Online and Mobile banking and you can also visit our ATM's which are also open 24/7.

What is your holiday schedule?

What is your holiday schedule?

Please visit our Locations page to view our holiday closures.

Do you offer safe deposit boxes?

Do you offer safe deposit boxes?

Yes, most branches have safe deposit boxes for rent. Please call the branch for availability.

Oahu

- Main

- Kailua

- Kapiolani

- Kalihi

- Pearl City

Hawaii Island

- Puainako

Maui

- Kahului

How do I find my account number?

How do I find my account number?

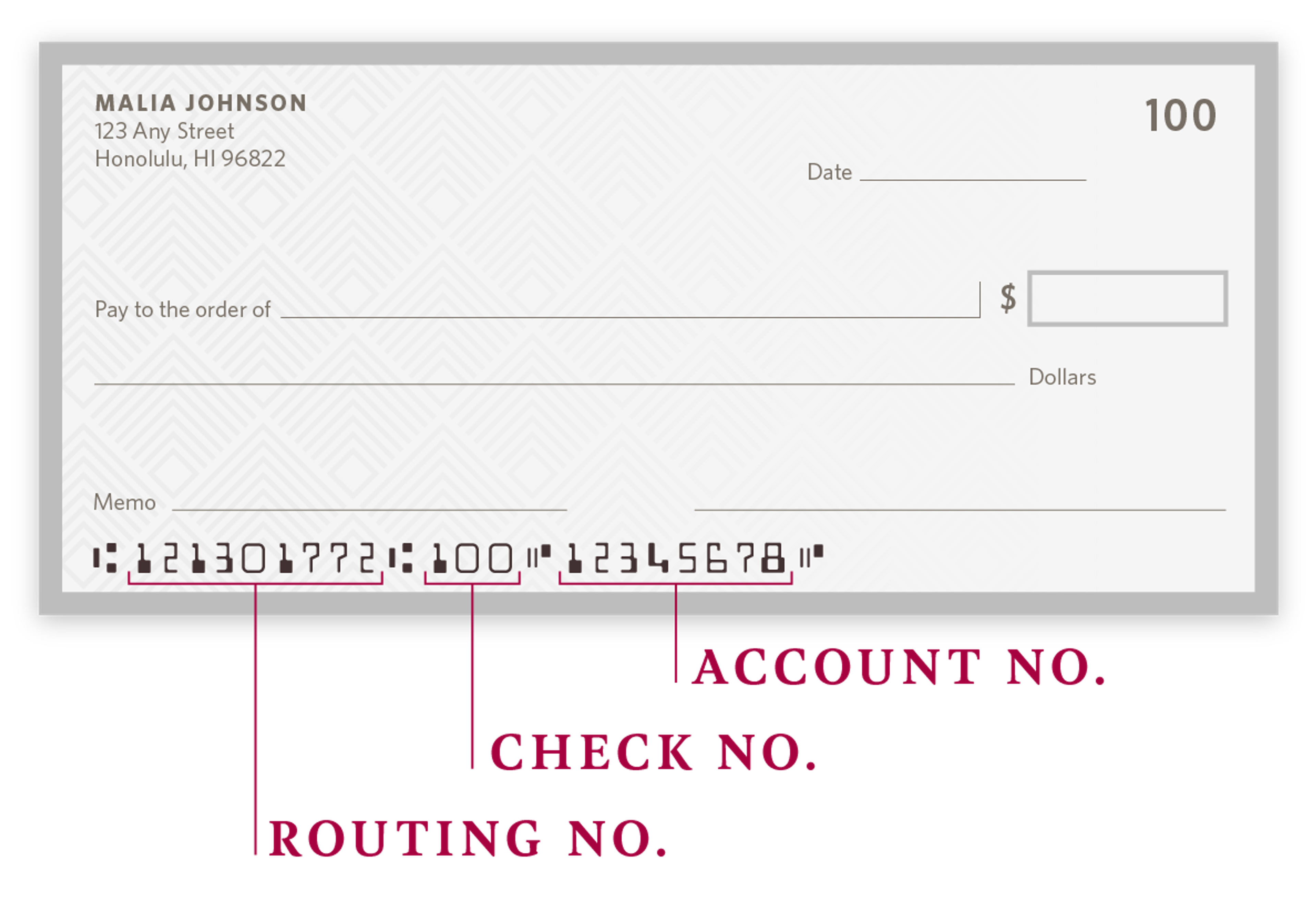

Your account number can be found through your Online and Mobile Banking, and on your checks. The account number is printed along the bottom after the routing number and check number.

If you cannot find your account number, please call your branch of account.

How do I update my account details?

How do I update my account details?

You can update your email address and phone numbers through Online and Mobile Banking. Please contact your branch of account for name or address changes.

I need more checks. How do I reorder them?

I need more checks. How do I reorder them?

You can easily request new checks online at https://orderpoint.deluxe.com/personal-checks/welcome.htm.

How do I check my balance?

How do I check my balance?

You may check your balance online, through our mobile app, at an ATM or at any branch.

How do I enroll in eStatements?

How do I enroll in eStatements?

Opt-in for electronic statements and notifications through the Online Banking platform. For step-by-step instructions, please click here.

How can I access my eStatements?

How can I access my eStatements?

eStatements can be accessed through Online Banking and Mobile Banking. In Online Banking, click the “Statements” icon in your dashboard. In the mobile app, scroll left on the dashboard and click on the "Statements" icon.

What is the difference between Monthly Average Balance and Minimum Daily Balance?

What is the difference between Monthly Average Balance and Minimum Daily Balance?

Minimum Daily Balance refers to the ending balance for each day within the given statement cycle. Monthly Average Balance takes the average of each daily ending balance over the statement period.

I noticed an error on my account. How do I dispute a transaction?

I noticed an error on my account. How do I dispute a transaction?

We’re sorry for this error. Please call or visit a branch to dispute a transaction.

I am interested in working at Hawaii National Bank. How do I apply?

I am interested in working at Hawaii National Bank. How do I apply?

Please view our open positions on our Careers page and complete an online application.

ATMs

Where are Hawaii National Bank ATMs located?

Where are Hawaii National Bank ATMs located?

There is an ATM available at all branch locations, listed here. Most Hawaii National Bank ATMs are accessible 24/7. Select ATMs also take in envelope-free deposits and can dispense multiple bill denominations.

What are the withdrawal limits at Hawaii National Bank ATMs?

What are the withdrawal limits at Hawaii National Bank ATMs?

The limits may vary by user. The standard limit is $500 per account per day. Please contact Digital Banking at (808) 528-7800 or DigitalBanking@HawaiiNational.bank if you have any questions.

Is there an ATM fee?

Is there an ATM fee?

There is no ATM fee if you use your Hawaii National Bank debit/ATM card at a Hawaii National Bank ATM. If you use your card at a non-Hawaii National Bank ATM, Hawaii National Bank will assess a $1.00 foreign ATM withdrawal fee. Additional fees may be assessed by the ATM's financial institution.

Debit & Credit Cards

What if my card is lost or stolen? What if I notice suspicious activity?

What if my card is lost or stolen? What if I notice suspicious activity?

Please contact the appropriate number immediately:

Debit Cards

During Business Hours (M-F 7:30am-6pm):

- Digital Banking Department: (808) 528-7800

Outside Business Hours

- Within the US: (888) 297-3416

- Outside the US: (206) 389-5200

You may also temporarily block your debit card if you notice suspicious activity through our Online and Mobile Banking app.

Credit Cards

Call the number on the back of your card, or:

- Consumer Cards: (800) 558-3424

- Business Cards: (866) 552-8855

What are the default spending limits for personal debit cards?

What are the default spending limits for personal debit cards?

The default spending limits for personal debit cards are:

- $3,000 for debit card POS purchases

- $500 daily limit for ATM cash withdrawals

The default spending limits for Seed debit cards are:

- $300 for Seed debit card POS purchases

- $100 daily limit for ATM cash withdrawals

Please note: Your debit card limits may differ from these default limits. Please contact your branch of account or our Digital Banking team at (808) 528-7800 if you have any questions.

Do you offer credit cards?

Do you offer credit cards?

Yes, we have a variety of credit cards available with different benefits. Please contact us or stop by any branch and we’ll be happy to find the right card for you. You can also compare cards and apply directly online.

Is my debit card contactless?

Is my debit card contactless?

All newly issued and replacement cards after March 1, 2021 will include a contactless feature. You can confirm that your card is contactless if there is the contactless symbol on the back of the card near the security code.

To view the Contactless Debit Card FAQ, please click here.

I'll be traveling and I want to use my debit card.

I'll be traveling and I want to use my debit card.

You can set up travel notices in both Online and Mobile Banking. Click on your settings and go to "Travel Notices". Click on "Add Travel Notice" to enter information about your trip and to select the debit cards you will be using. You may also call our Digital Banking Department for assistance at (808) 528-7800.

Business Account

Can I apply for a business account online?

Can I apply for a business account online?

We do not allow business accounts to be opened online at this time. Please call (808) 528-7711 or visit any of our branches.

I have a business account. Can I enroll in Online Banking?

I have a business account. Can I enroll in Online Banking?

Yes. Please complete our Business Enrollment & Maintenance Form and email it to our Digital Banking Department at DigitalBanking@HawaiiNational.bank, or take it to any of our Hawaii branches. A valid government-issued ID is required for all Business Online Banking users.

How do I update my business Online Banking account?

How do I update my business Online Banking account?

Please download and complete the Business Enrollment & Maintenance Form. A valid government-issued ID is required for all Business Online Banking users.

How do I reorder checks?

How do I reorder checks?

You can order new Business checks securely online at https://www.deluxe.com/shopdeluxe/home.

Online Banking

What’s the difference between Online Banking and Mobile Banking?

What’s the difference between Online Banking and Mobile Banking?

You can access Online Banking through your desktop or laptop with an Internet connection. Mobile Banking is accessed through the Hawaii National Bank mobile app on your smart phone.

How do I enroll in Online Banking?

How do I enroll in Online Banking?

Please go to the Online Banking enrollment page to enroll in Online Banking.

Can I make a deposit online?

Can I make a deposit online?

Deposits cannot be made through the Online Banking platform. However, deposits can be made through our mobile app. See the Mobile Deposit FAQ section for more information.

I’ve forgotten my Online Banking password. What do I do?

I’ve forgotten my Online Banking password. What do I do?

Please go to the Online Banking forgot page and provide the requested information.

I’ve forgotten my Online Banking username. What do I do?

I’ve forgotten my Online Banking username. What do I do?

Please go to the Online Banking forgot page and click on "Try another way" and provide the requested information.

I’m locked out of my account. What do I do?

I’m locked out of my account. What do I do?

Entering incorrect security information three or more times will temporarily lock your account as a security precaution. Contact us at (808) 528-7800 or DigitalBanking@HawaiiNational.bank if you need additional assistance.

What are the recommended browsers to use with Online Banking?

What are the recommended browsers to use with Online Banking?

We recommend using any of the browsers below:

- Google Chrome

- Mozilla Firefox

- Apple Safari

- Microsoft Edge

*Please note that Internet Explorer will no longer be supported by future internet banking updates.

Mobile Banking & App

What’s the difference between Online Banking and Mobile Banking?

What’s the difference between Online Banking and Mobile Banking?

You can access Online Banking through your desktop or laptop with an Internet connection. Mobile Banking is accessed through the Hawaii National Bank mobile app on your smart phone.

How do I download the Hawaii National Bank mobile app?

How do I download the Hawaii National Bank mobile app?

You can download the app via the Apple App Store or the Google Play Store.

What devices are supported?

What devices are supported?

Android operating system: Android 10.0 (API Level 29) and up

IOS operating system: iOS 18.0 or later

Will I be charged a fee for using the Mobile Banking app?

Will I be charged a fee for using the Mobile Banking app?

No. Hawaii National Bank offers 24/7 Mobile Banking as a convenient free service for all of our customers enrolled in Online Banking. However, there may be charges associated with data usage on your phone. Check with your wireless phone carrier for more information.

Do I need a data plan?

Do I need a data plan?

To access the Hawaii National Bank Mobile Banking app, you will need an Internet connection. There may be charges associated with data usage on your phone. Check with your wireless phone carrier for more information.

How does the device registration process work?

How does the device registration process work?

- Enroll in Online Banking from a desktop computer.

- Download the Mobile Banking app on your mobile device.

- Register your mobile device by entering your Online Banking username and password. You must enroll in two-factor authentication to access Mobile Banking.

- Once two-factor authentication is set up, you may log in to your Mobile Banking.

I’m having trouble registering my device. What do I do?

I’m having trouble registering my device. What do I do?

Contact us at (808) 528-7800 or DigitalBanking@HawaiiNational.bank.

I’ve forgotten my username/password. What do I do?

I’ve forgotten my username/password. What do I do?

Please click on the “Forgot” button on your Mobile Banking app login screen and follow the instructions provided.

I’m locked out of my account. What do I do?

I’m locked out of my account. What do I do?

Entering incorrect security information three or more times will temporarily lock your account as a security precaution. Contact us at (808) 528-7800 or DigitalBanking@HawaiiNational.bank if you need additional assistance.

Do I need to log in to view my account balance?

Do I need to log in to view my account balance?

Yes, however, you can check on "Remember this device" when logging in to make future log in attempts faster. If your device allows biometrics, you may also enable that to easily access your account.

What if I lose my mobile device?

What if I lose my mobile device?

Access to the Mobile Banking app is password protected. To ensure your security, contact us at (808) 528-7800 or DigitalBanking@HawaiiNational.bank to block your device for Mobile Banking. You can also call your mobile service provider to have your device disabled.

What is Touch ID or Fingerprint Identification?

What is Touch ID or Fingerprint Identification?

Supported Apple and Android devices will allow you to use fingerprint authentication instead of your password to log in to the Mobile Banking app. Supported Apple devices will also allow you to use Face ID which uses facial recognition instead of your password to log in.

Do I need to enter my password when I use Touch ID/Fingerprint Identification or Face ID?

Do I need to enter my password when I use Touch ID/Fingerprint Identification or Face ID?

No. Once Touch ID, Fingerprint Identification, or Face ID is enabled on your supported smart phone, your fingerprint or facial recognition is the only required login credential. You will need to enter your password to make certain banking transactions.

Mobile Deposit

What is Mobile Deposit?

What is Mobile Deposit?

Mobile Deposit allows you to conveniently and securely deposit checks by taking a photo of your check with your smart phone and uploading it through our Mobile Banking app. Please view step by step instructions on how to use Mobile Deposit here.

Are there fees for using Mobile Deposit?

Are there fees for using Mobile Deposit?

No. Mobile Deposit is a free service for customers. There may be charges associated with data usage on your phone. Check with your wireless phone carrier for more information.

What are the limits for Mobile Deposit?

What are the limits for Mobile Deposit?

Please call digital banking to confirm your limit. Limits are based on customer's account standing. Please refer to the HNB Mobile Capture Agreement for more information.

What is the processing time for checks submitted through Mobile Deposit?

What is the processing time for checks submitted through Mobile Deposit?

4 p.m. Hawaii Standard Time (HST). Checks submitted after 4 p.m. HST or on weekends and holidays will be processed as if they were submitted on the next business day. Funds are usually available the next business day.

How should I endorse and handle checks deposited through Mobile Deposit?

How should I endorse and handle checks deposited through Mobile Deposit?

Checks must be endorsed with “For Mobile Deposit at Hawaii National Bank.” After deposit, we will send you a confirmation that we have received an image of the check. Mark the check “Electronically Presented” and retain for your records until the check is processed. Do not resubmit the check.

Bill Pay

What is Bill Pay?

What is Bill Pay?

Bill Pay allows you to make payments to anyone with a mailing address in the United States from your Hawaii National Bank account. You can make payments with the Mobile Banking app on a mobile device, or through Online Banking on a desktop or laptop computer.

How do I sign up for Bill Pay?

How do I sign up for Bill Pay?

Personal customers can enroll through Online Banking.

Business customers need to contact Digital Banking at (808) 528-7800 or DigitalBanking@HawaiiNational.bank. By signing up for our Business Bill Pay, you are agreeing to our monthly fee for the service.

Is there a fee for Bill Pay?

Is there a fee for Bill Pay?

There is no fee for our Consumer Bill Pay service. Business Bill Pay fees are $5.95/month + $0.29/transaction for business accounts. Please contact our Digital Banking team at (808) 528-7800 or DigitalBanking@HawaiiNational.bank to sign up for Business Bill Pay.

How do I add a payee?

How do I add a payee?

Log in to Online Banking and access your Bill Pay profile to add payees.

How do I cancel a scheduled payment?

How do I cancel a scheduled payment?

Under the “History” tab, swipe left or click on the payment you want to cancel and click “Cancel.” You will be prompted to confirm the cancellation.

I need help with Bill Pay.

I need help with Bill Pay.

You may contact our Digital Banking Team for assistance with Bill Pay at (808) 528-7800 or DigitalBanking@HawaiiNational.bank.

External Transfers

What are external transfers?

What are external transfers?

External transfers allow personal account holders to conveniently transfer funds between accounts they own at Hawaii National Bank and other financial institutions.

Is there a fee for external transfers?

Is there a fee for external transfers?

No, this service is free for personal account holders.

Are there external transfer limits?

Are there external transfer limits?

Please call Digital Banking at (808) 528-7800 to confirm your limit. Limits are based on customer's account standing.

When are external transfers processed?

When are external transfers processed?

External transfers will be processed on the date you specify, and the funds will usually be made available in 3-5 business days.

Can I complete an external transfer to an account that is not my own?

Can I complete an external transfer to an account that is not my own?

No, you must be the owner of both accounts.

How do I add an external transfer account in Online Banking?

How do I add an external transfer account in Online Banking?

Please view our External Transfers Guide for step-by-step instructions.

How do I add an external transfer account in Mobile Banking?

How do I add an external transfer account in Mobile Banking?

- After logging in to the mobile app, click on the "Transfer" icon on the dashboard.

- Click on “Make external transfers” and follow the instructions.

Note: You will need to verify the external account by confirming small deposits made into the account.

Can’t Find Your Question?

Our team is ready to answer.